If your are having a hard time keeping up with your credit card debt, you may start getting calls from a debt collector. This can be very stressful! You need to know what a debt collector can do and cannotg do. This will help!

There are many reasons you may be falling behind in making at least your minimum payments:

There are many reasons you may be falling behind in making at least your minimum payments:

- Laid off or reduced hours due to Covid-19

- Divorce

- Loss of loved one

- Too little fixed income in retirement

- Illness or disability

- Just bad decisions

So if you don't have enough stress right now, the phone rings and the caller says something like,

" This is Bob from XYZ collections. We have your Visa Card account with a balance of $8,500. You must make a payment today or we may decide to turn your account over to an attorney for collection!"

You try to explain your situation, but it doesn't do any good.

He starts back in saying there are several options they have for collection, including:

- Lawsuits

- Garhishments

- Bank Levy

- Lien against your home

You hang up and start thinking:

Can they start taking money from my paycheck? I can barely make ends meet now!

If they take money out of my bank account, I can't pay the rent or mortgage!

Will I have to sell my house if they put a lien on it?

And your mind just keeps going....

OK, calm down.

There are several laws to protect consumers from illegal debt collection efforts found in the Fair Debt Collection Practices Act (FDCPA).

Can debt collectors contact me any time or any place?

They cannot call before 8am or after 9pm.

They can call you at work, but you can stop them by telling them you cannot receive calls at work.

Once your account is transferred or sold to a collection agency, you can put a stop to the calls:

Can a Debt Collector take money from my paycheck or bank account?

A debt collector cannot touch your money (paycheck or bank account) without first obtaining a judgment and writ of levy from the court.

Having said that, there are certain types of debts that don't require a court order for garnishments, such as:

- Failure to pay alimony or child support

- Taxes

- Federal Student Loans (each state has different laws)

There are several sources of income that are exempt from garnishments or levies:

- Social Security

- Pension and/or retirement funds

- Alimony or Child support

- Disablitiy income

But, as far as your unsecured debts (credit cards, personal loan, medical bills, etc.) are concerned, there is a whole process that must take place BEFORE a creditor can garnish or levy.

After the original creditor or the debt collector attempts to get you to start making payments by making numerous calls and sending letters, they may dedice to seek legal options.

First, they must FILE A COMPLAINT in the county court where you live.

This will result is a SUMMONS that must be delivered to you.

The summons will state that the PLAINTIFF (creditor) is CLAIMING that you owe a certain amount for this specific debt.

It will also say that you have 30 days (varies by state or court) to APPEAR AND GIVE AN ANSWER.

Although this sounds like you have to go to court, that's not what it means!

If you will read carefully, the words "APPEAR" and give an "ANSWER" are in italics!

This basically means that if you CAN PROVE (with written, clear documentation) that you do not own this debt, you have 30 days (or whatever you state or court says) to file an ANSWER with the court.

This ANSWER must be in the proper, legal form and therefore may require an attorney to prepare and there is a filing fee as well. But, these costs may be worth it if you can PROVE (not just say) that you do not owe the debt.

But if you owe the debt they are CLAIMING you owe, what now?

Now you have to take action!

You need to contact the attorney for the plaintiff (collector) and see if you can work out a repayment plan or settlement to keep them from moving forward with their lawsuit!

Please....DO NOT IGNORE THE SUMMONS! It will not just "go away"!

First, some VERY IMPORTANT POINTS...

First, some VERY IMPORTANT POINTS...

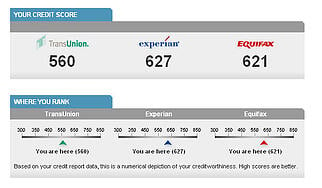

A lady from Portland, Oregon called to ask, "What really determines my credit score?"

A lady from Portland, Oregon called to ask, "What really determines my credit score?" The amount of debt the average American has been estimated to be close to $8,000! If you get behind on paying your debts, get ready to hear from DEBT COLLECTORS!

The amount of debt the average American has been estimated to be close to $8,000! If you get behind on paying your debts, get ready to hear from DEBT COLLECTORS! Making the choice between BANKRUPTCY and DEBT SETTLEMENT can be a daunting task. The fact is, one is not the clear winner. The option you choose will depend on several factors.

Making the choice between BANKRUPTCY and DEBT SETTLEMENT can be a daunting task. The fact is, one is not the clear winner. The option you choose will depend on several factors.

When your debts are out of control and you miss or get behind in payments, the creditor will do whatever they can to collect, including calling and calling and calling....

When your debts are out of control and you miss or get behind in payments, the creditor will do whatever they can to collect, including calling and calling and calling.... Can I use debt settlement in Oregon to clear up old debts?

Can I use debt settlement in Oregon to clear up old debts? Can a Debt Collector Garnish Retirement Income?

Can a Debt Collector Garnish Retirement Income?